The seeds of urbanisation that were sown in the sleepy town of Gurgaon (now Gurugram) in the early 90s are now bearing fruit.

Today, Gurugram, located in the Delhi National Capital Region (NCR), has become the abode of top corporations due to its affordable commercial real estate and high-quality infrastructure, which compares favourably to Mumbai’s commercial hubs. It has now rivalled the maximum city in terms of luxury residential real estate.

Legend had it that in those days, Gurugram farmers sold their land to real estate developers and bought Ferraris. Today, that land is minting gold. What started as a hub of call centres and malls, has now become the nerve centre of the economy, housing top corporates like Air India, IndiGo, Maruti, JSW MG Motors, and Hyundai, to name a few. Gurugram has even dwarfed Delhi in terms of real estate pricing and quality of life, prompting many to relocate.

Now, the Haryana city has emerged as a challenger to Mumbai and, in fact, has surpassed the western metropolis in terms of the number of luxury homes sold in a year, though India’s commercial capital still rules in per sq.ft. rate and in transaction ticket size.

“Gurugram has become the abode of luxury homes priced above ₹5 crore each. The average size of Gurugram apartments has increased from 1,800 sq.ft. to 2,600 sq.ft, and with this, the ticket size of apartments has crossed ₹5 crore, making it the top destination for luxury homes,” said Samir Jasuja, MD, PropEquity, a real estate analytics firm that has conducted research on the trend.

In 2024, about 79,000 luxury homes were sold in Gurugram, which is about 50% of all luxury homes sold in India. In Mumbai, about 33,000 units of luxury homes were sold that year, according to PropEquity data.

Prefer larger homes

In Gurugram — like in most of North India — people prefer larger homes, and thus the price per unit has gone up, while in Mumbai, due to high property prices, local developers offer apartments of smaller sizes, which is the reason behind Gurugram stealing the show. The people who are buying luxury homes in Gurugram include NRIs, HNIs, investors and end-users like CXOs working in top Indian and multinational companies.

“Employment generation, proximity to Delhi airport, great infrastructure and superior construction have led to demand for luxury homes in Gurugram, leading to price escalation,” Mr. Jasuja said.

He said the demand momentum would continue as people are getting richer and seeking high-quality living.

For example, DLF Ltd. — India’s top real estate developer,responsible for modernising and urbanising Gurugram — sold 1,100 units in its DLF Camellias project, which is priced over ₹9 crore each, in one week recently.

In tune with the demand, almost all developers have now shifted their focus to luxury homes, as the return is far better than in other segments of housing.

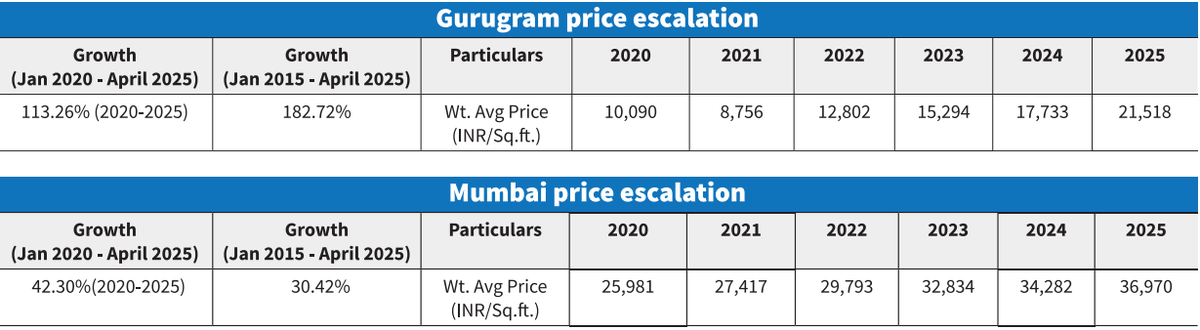

The price appreciation in Gurugram has been phenomenal compared to Mumbai, which is a landlocked city. As per PropEquity data between January 2020 and April 2025, the property prices in Gurugram appreciated by 113.26%, while it was only 42.30% in Mumbai in the same period.

In the period between January 2015 and April 2025, property prices in Gurugram appreciated 181.72%, while it was a mere 30.42% in Mumbai.

In 2020, the weighted average price per sq.ft. was ₹10,090 in Gurugram, while it was ₹25,981 per sq ft in Mumbai.

In 2021, it dropped to ₹8,756 per sq.ft. in Gurugram, while it increased to ₹27,417 per sq.ft. in Mumbai.

In 2022, 2023, 2024 and 2025, the weighted average price increased to ₹12,802, ₹15,294, ₹17,733, and ₹21,518 per sq.ft. respectively, in Gurugram. While in Mumbai, it rose to ₹29,793, ₹32,834, ₹34,282 and ₹36,970 per sq.ft. respectively.

Gurugram might have stolen the thunder in terms of the average size of luxury apartments, but Mumbai still commands the highest price in terms of per sq.ft. rate.

In Gurugram, the highest price was about ₹1,90,000 per sq.ft. whereas in Mumbai, it was ₹2,50,000 per sq.ft.

“These are one of the transactions, but in general, Gurugram has arrived,” Jasuja said. In 2024, the demand for luxury homes in Gurugram increased 66% to nearly ₹1.07 lakh crore as per PropEquity’s estimates.

Areas like Golf Course Road are witnessing a surge in ultra-luxury housing as the city, which has transformed into a major corporate hub, is attracting professionals from all over, including Mumbai.

P. Pandey, a long-time Mumbai resident, shifted base to Gurugram post-COVID for work. So did F. D’Souza. Both are seeking premium living, fuelling the demand for luxury homes.

Santhosh Kumar, vice chairman of ANAROCK Group, said Gurugram has undoubtedly seen a surge in activity in ultra-luxury properties, with both demand and new supply seeing a significant jump over the last few years.

As per Anarock Research, back in Q1 2023, as many as 1,920 units were launched in the ultra-luxury category priced at ₹2.5 crore in the city, while in Q1 2025, the new supply in this category increased to 7,610 units – a whopping 296% jump in the last two years, he said.

Meanwhile, in mainland Mumbai, the new supply of ultra-luxury homes in Q1 2023 exceeded Gurugram’s back then, with approximately 2,110 units. However, in Q1 2025, new supply in this budget category was nearly 4,900 units – at least 55% lower than in Gurugram, he added.

“This is essentially because post the pandemic, we are seeing high demand for luxury homes, and developers who previously refrained from launching projects in this category are now coming forward,” Kumar said.

Rise in demand

He said due to steadily rising demand, new supply in the ultra-luxury category by large and listed developers has increased substantially. Developers are seen cashing in on the rising demand.

One of the major beneficiaries of the changing trend is real estate company Signature Global (India), which has a large presence in Gurugram.

Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd., said only in the last five years has the city emerged as the epicentre of premium housing.

Its status as a corporate hub has led to significant internal migration from various parts of Delhi NCR and neighbouring states, thereby fuelling sustained demand for quality housing, he said.

Key hotspots such as Dwarka Expressway, Southern Peripheral Road, Sohna, and South Gurugram have witnessed a steady rise in property prices. This growth has been largely driven by rapid infrastructure development, improved connectivity across Delhi-NCR, and a growing demand for high-quality residential spaces from both end-users and investors, Aggarwal said.

Mumbai’s enduring appeal

Meanwhile, Mumbai’s developer community does not accept Gurugram’s ascent.

According to Manju Yagnik, Vice Chairperson, Nahar Group, and Senior Vice President, NAREDCO Maharashtra, while Gurugram has certainly seen a surge in the number of luxury housing transactions, “Mumbai remains unequivocally the crown jewel of India’s luxury real estate market — not just in terms of legacy, but also in value.”

“In 2023 alone, Mumbai recorded luxury home sales worth over ₹38,000 crore, with average prices in prime locations like South Mumbai, BKC, and Juhu ranging from ₹85,000 to ₹1.5 lakh per sq.ft. — nearly three to five times higher than luxury rates in Gurugram,” she said.

“What sets Mumbai apart is not just the price tag but the deep-rooted aspirational value, global investor interest, and scarcity-driven demand. It’s a land-constrained city with a coastline, heritage zones, and limited vertical expansion, which continues to drive price appreciation,” she said.

“Even though Gurugram may have surpassed Mumbai in transaction numbers temporarily, Mumbai continues to lead in total value, per square foot pricing, and long-term capital appreciation — making it the true epicentre of India’s luxury real estate landscape,” she said.

Amit Vakharia, VP Projects, Ashar Group, known for the redevelopment of late actor Dilip Kumar’s bungalow at Pali Hill in Mumbai, said that though the number of luxury housing transactions had gone up in Gurugram, Mumbai still “remains and retains the gold standard in value, prestige, and per-square-foot supremacy”.

“With luxury residences in Malabar Hill, Bandra, and Worli often selling for over ₹1 lakh per sq. ft., and individual transactions ranging from ₹50 crore to over ₹200 crore, the city reflects a market led by HNIs and UHNIs who seek branded and well-located addresses,” he said.

He added that Mumbai offered more than homes; it delivers a legacy of heritage, unmatched connectivity, panoramic sea views, and direct access to India’s financial capital. “As other luxury landscapes evolve, Mumbai continues to set the benchmark for value, aspiration, and investment confidence in Indian luxury real estate,” he said.

MUMBAI

Leena Gandhi Tewari, chairperson, USV Ltd, has reported bought two luxury duplex flats for ₹639 crore in Worli. The duplexes, spreading across four floors, cover a total area of 22,572 sq.ft. The price works out to ₹2.83 lakh per sq.ft., making it perhaps the costliest residential deal in India.

Tanya Dubas, Executive Director of Godrej Industries Group and daughter of Adi Godrej, through Shaula Real Estates Private Ltd, has purchased a duplex apartment for ₹225.76 crore in Worli. With a total built-up area of 11,485 sq ft, the per sq.ft. prices work out to ₹1.97 lakh.

In October 2024, Shreegopal Kabra, promoter of RR Kabel and his family, purchased two luxury apartments in Worli for ₹198 crore. The apartments spread over 13,809 sq ft, translating into a price of ₹1,43,000 a sq.ft.

GURUGRAM

Rishi Parti, CEO of Info-x Software Technology, set a record in Gurugram by purchasing a 16,290-square-foot penthouse at DLF Camellias for ₹190 crore. At that price, the per sq.ft. rate works out to ₹1,17,000.

#Gurugram #beats #Mumbai #luxury #housing